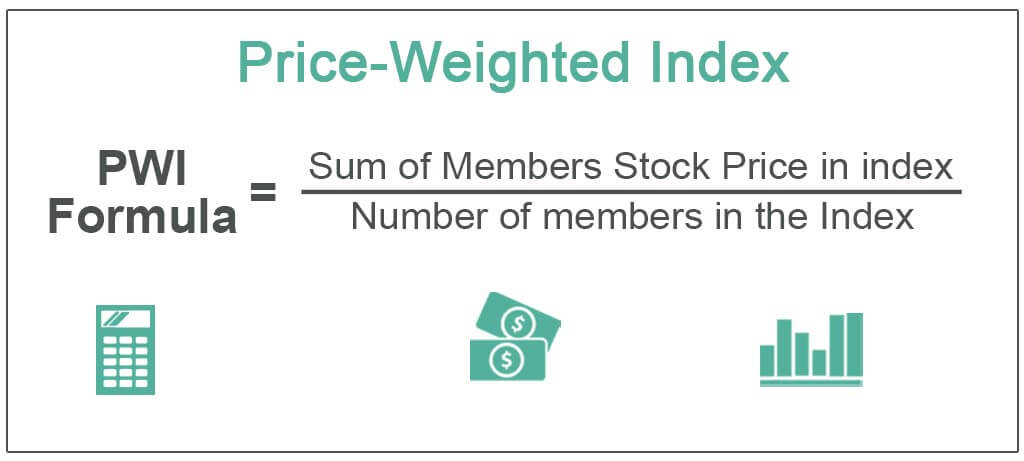

Price weighted index formula

Add the stock price of each company in the index at the start of the period. In practice this formula becomes more complicated.

Price Weighted Index Formula Examples How To Calculate

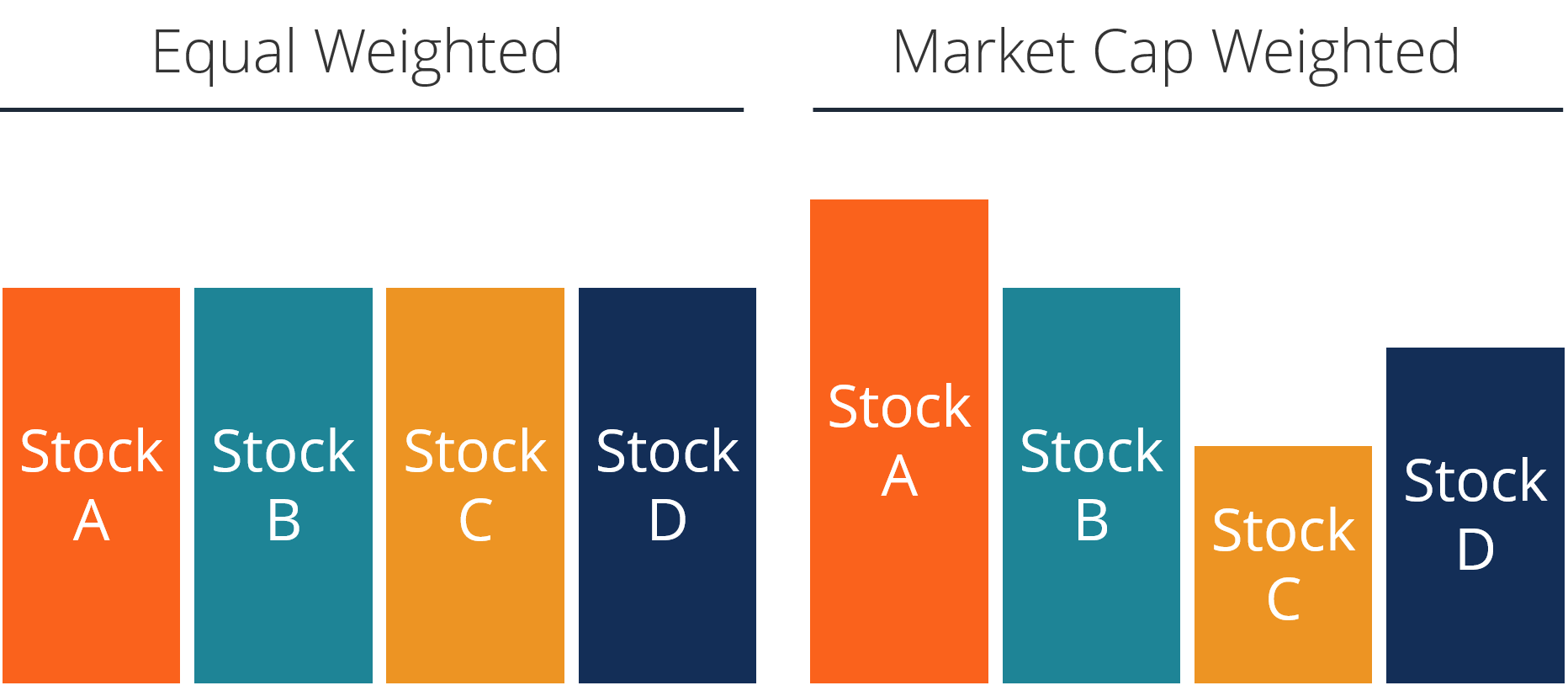

Equal weight is invested in each of the stocks in an index with equal dollar.

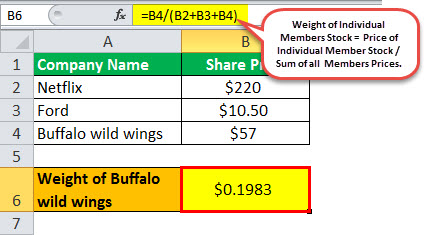

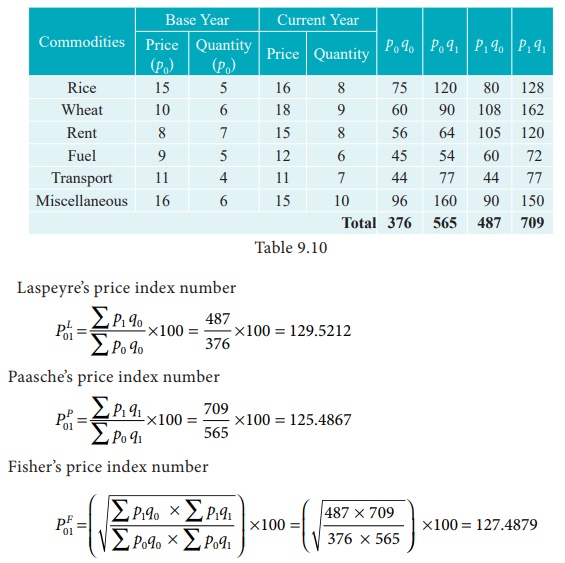

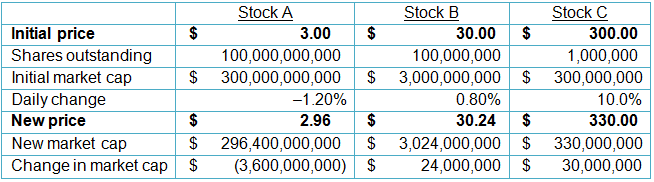

. The weight of each stock in a price-weighted index can be calculated by dividing its stock price per share by the sum of share prices of all the stocks in the index. In a price weighted index the price of a single share of each constituent is added to the index. The weighted index number is given by P_01 fracsum P_1 wsum P_0 w times 100 Here.

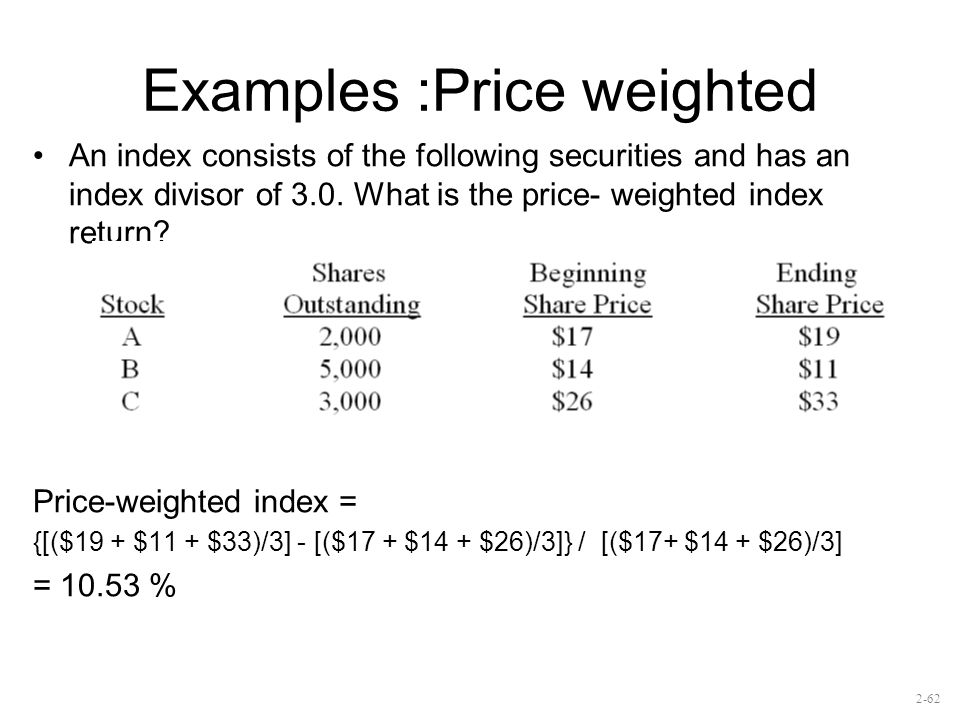

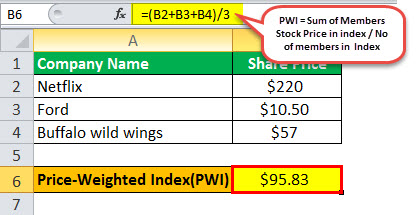

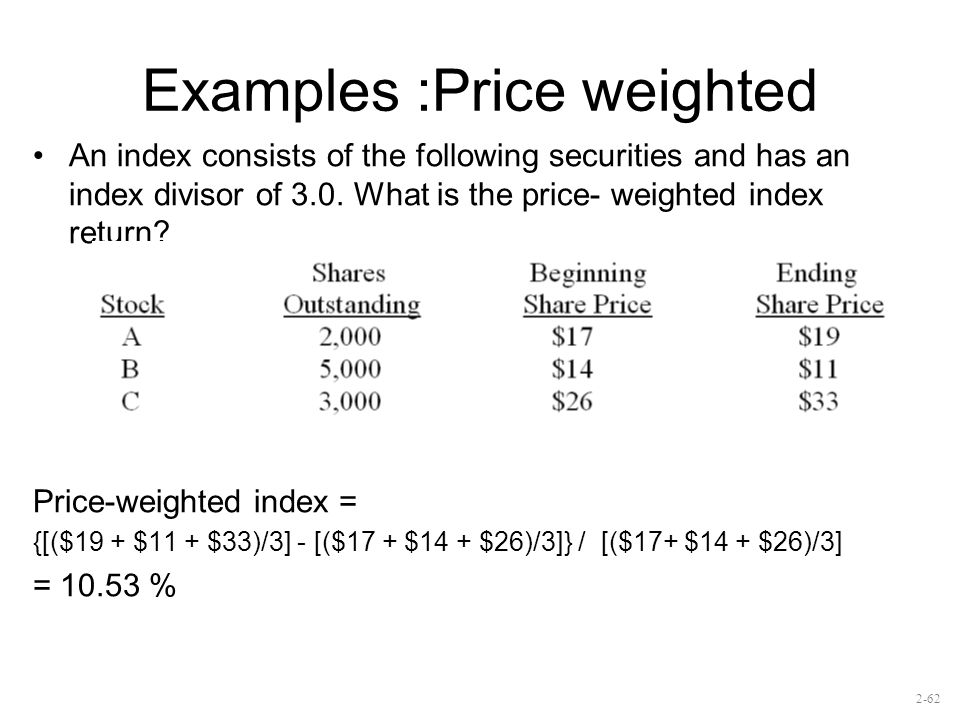

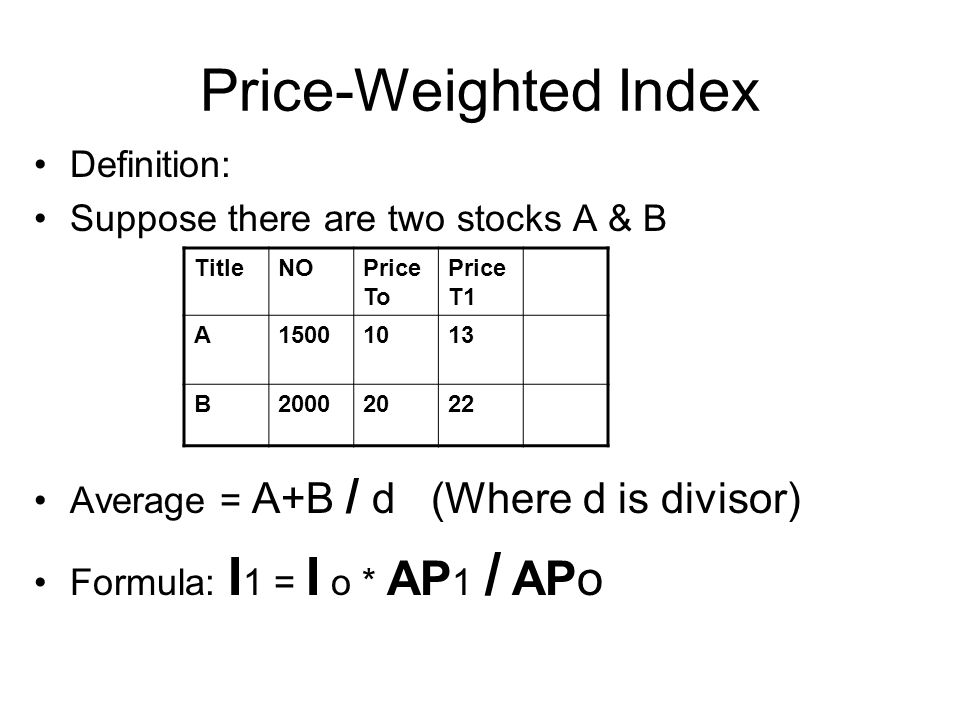

Stocks with higher prices are given. A price-weighted index is simply the sum of the members stock prices divided by the number of members. For example if you want to figure the rate of return for a given year add the opening stock prices of each.

A price index aggregates various combinations of base period prices later. Formula for the Paasche Price Index. To calculate a price-weighted average or any arithmetic average for that matter simply add the numbers stock prices together and then divide by the number of stocks in the.

A price-weighted index is a stock market index where each constituent makes up a fraction of the index that is proportional to its component the value would be. I dfrac current market cap base market cap times base value. In a PWI the weight of a constituent company ie.

The formula for the index is as follows. Pi0 is the price of the individual item at the base period and Pit is the price of the. 5 7 10 20 1 43 5 86.

The individual share prices of all constituents added together create the initial. Remember that the Laspeyres Price Index uses. The value-weighted index formula is.

The formula for the Laspeyres Price Index is as follows. Some functions have side effects such as SubmitForm which are appropriate only in a behavior formula such as ButtonOnSelect. With a price-weighted index the index trading price is based on the trading prices of the individual stocks that make up the index basket.

Pi0 is the price of the individual item at the base period and Pit is the price of the individual item at the. Functions are modeled after Microsoft Excel functions. What is the formula for weighted index numbers.

Thus in our example the XYZ index is. The steps taken to calculate the Index should be as follows. Included in the index is computed by dividing its stock price by the sum of all the constituent companies stock prices.

1 Adjustment Factor Index. While price index formulae all use price and possibly quantity data they aggregate these in different ways. Calculate the Laspeyres Price Index for each period.

A simple arithmetic or geometric average used to calculate stock indexes.

:max_bytes(150000):strip_icc()/dotdash_Final_Equal_Weight_Apr_2020-01-6b2bdb8ccaf74b8d9170fafe5851d5df.jpg)

Equal Weight Definition

Solved Price Weighted Index Constructed With The Three Stocks 2 What Is The Value Weighted Index Constructed With The Three Stocks Using A Divis Course Hero

Introduction To Fundamentally Weighted Index Investing

Price Weighted Index Formula Examples How To Calculate

Simple Index And Weight Index Examples In R

/dotdash_Final_Equal_Weight_Apr_2020-01-6b2bdb8ccaf74b8d9170fafe5851d5df.jpg)

Equal Weight Definition

Price Weighted Index Return Youtube

Simple Index And Weight Index Examples In R

Weighted Index Number Definition Solved Example Problems Applied Statistics

Introduction To Fundamentally Weighted Index Investing

Price Weighted Index Formula Examples How To Calculate

Weighted Aggregate Price Index Mba Lectures

Does It Matter How An Index Is Put Together

Equally Weighted Index Financial Edge

How To Calculate Price Weighted Stock Market Index

Stock Market Index Ppt Video Online Download

Equal Weighted Index Definition Advantages And Disadvantages